EPFO Login [Member Login, UAN Login, Passbook]

EPFO Login serves as the gateway for both employees and employers to access a range of essential services offered by the organization. In India, the Government set up the Employees’ Provident Fund Organisation (EPFO) on March 4, 1952, under the Ministry of Labour and Employment. Its main goal is to support retired employees from private companies, ensuring they can take care of themselves and their families after retirement. The EPFO offers pension plans, insurance, and provident fund services to both male and female employees in private organizations across India who have been working for a long time.

The EPFO manages financial transactions for employees enrolled in the Employees’ Provident Fund (EPF) scheme. Over 240 million individuals have their accounts handled by this organization, and they receive benefits from various schemes. This article will provide information on EPFO Login, UAN Login, and other important details. If you are looking for details about EPFO Member Login, UAN Login, and more, make sure to read this article to the end.

EPFO Member Login Portal

The Employees’ Provident Fund Organisation (EPFO) plays a pivotal role in the lives of Indian workers, overseeing their Provident Fund contributions and safeguarding their retirement savings. The EPFO Member Login Portal serves as a personalized gateway, allowing you to access and manage this crucial financial resource. Whether you are a seasoned professional nearing retirement or a young worker just starting your career, understanding the nuances of the portal empowers you to take control of your financial future.

Accessing the Portal:

- Navigate to the EPFO website:

- Visit the official EPFO website: https://www.epfindia.gov.in/

- Access the Member e-Sewa Portal:

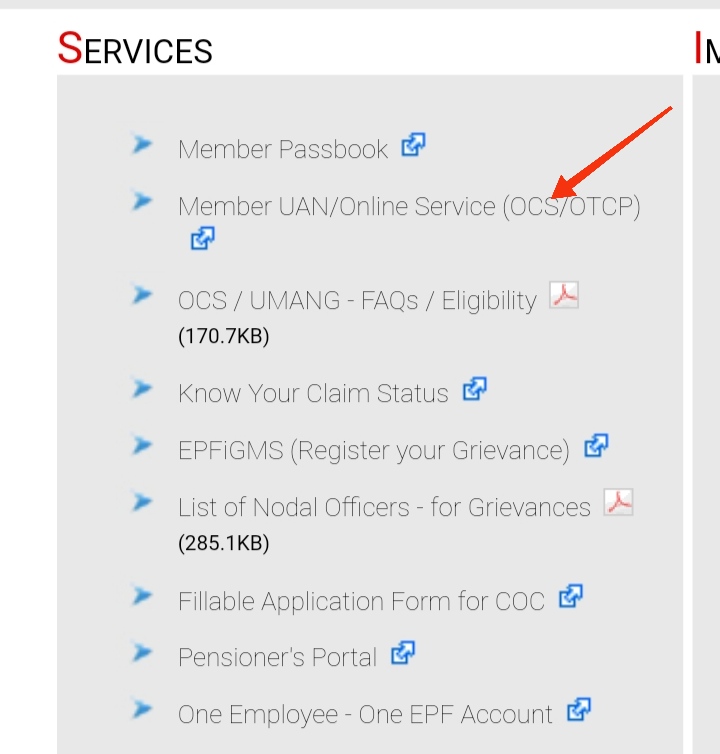

- Under the “Our Services” tab, select “For Employees,” and then choose “Member UAN/Online Services.”

Logging In:

- Enter your UAN and Password:

- Your Universal Account Number (UAN) acts as your unique identifier, while the password ensures the security of your account.

Welcome to Your Dashboard:

Once logged in, your comprehensive dashboard provides insights into your EPF details:

- Member Information: View personal details such as name, date of birth, gender, and more.

- Service Requests: Access options for filing claims, updating KYC information, downloading your UAN card, and more.

- Passbook: Track EPF contributions, view transaction history, and download statements.

- Grievances: Raise and track issues encountered with your EPF account.

- Help & Support: Find FAQs, user manuals, and EPFO customer support contact information.

Key Features You Can Access:

- View your complete EPF passbook: Monitor contributions, interest earned, and account balance over time.

- Track claim status: Check the progress of withdrawal or pension claims at any point.

- Update KYC information: Ensure accurate PAN, Aadhaar, and bank account details for seamless transactions.

- Download essential documents: Access UAN card, PF contribution statements, and claim forms readily.

- File online claims: Apply for withdrawals for specific needs like house purchase or medical treatment, or initiate pension claims.

- Manage nominations: Designate beneficiaries to receive your EPF corpus in unforeseen circumstances.

- Raise grievances: Report errors or issues encountered with your account and track their resolution.

Benefits of Using the Portal:

- Convenience: Manage your EPF account 24/7 from anywhere with an internet connection.

- Transparency: Gain real-time insights into contributions, account balance, and claim status.

- Accuracy: Streamline transactions and reduce errors through online systems.

- Security: Secure your account with a password and leverage features like KYC verification.

- Improved communication: Receive updates and notifications directly through the portal.

Remember:

- Keep your UAN and password confidential.

- Never share personal details over phone or email.

- Regularly update KYC information.

- Download and store important documents like PF statements.

- Contact EPFO customer support at 1800 118 005 for assistance.

By navigating the EPFO Member Login Portal confidently, you empower yourself to actively manage your EPF account, ensuring a secure and prosperous future. Your retirement savings are your own, and understanding how to access and manage them is key to financial security in your golden years.

- EPFO Helpdesk: 1800 118 005

- EPFO Member e-Sewa Portal: https://passbook.epfindia.gov.in/MemberPassBook/login

- EPFO Website: https://www.epfindia.gov.in/

EPFO Login UAN

Follow these steps to log in to your EPFO UAN account:

- Go to the Official EPFO Website:

Start by visiting the official EPFO website at https://www.epfindia.gov.in/

- Access the UAN Member e-SEWA Portal:

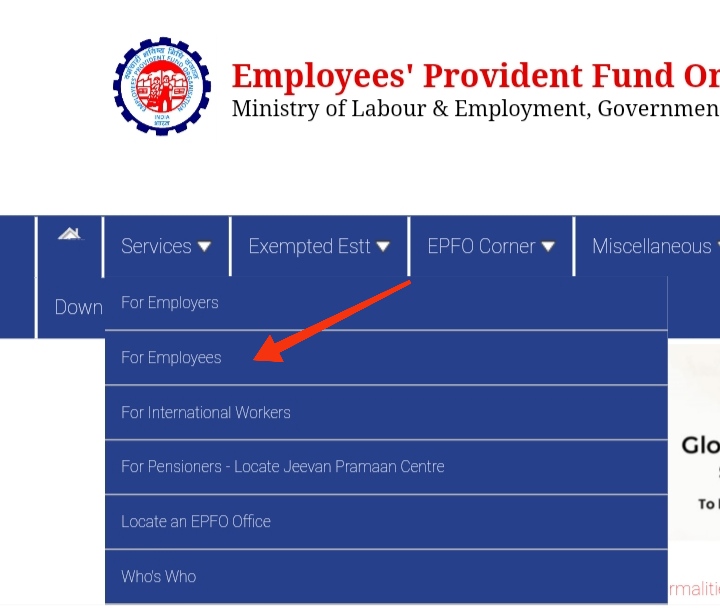

- Once on the homepage, click on the “Services” tab.

- Under “For Employees,” select “Member UAN/Online Services.” This action will redirect you to the UAN Member e-SEWA portal login page.

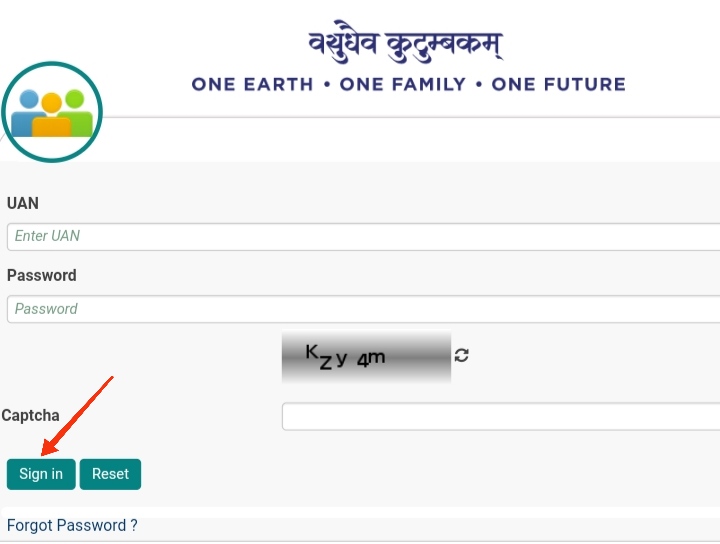

- Provide UAN and Password:

On the login page, enter the following details:

- Your UAN (Universal Account Number)

- Password associated with your UAN

- CAPTCHA code displayed

- Click “Sign In”:

After inputting the necessary information, click the “Sign In” button.

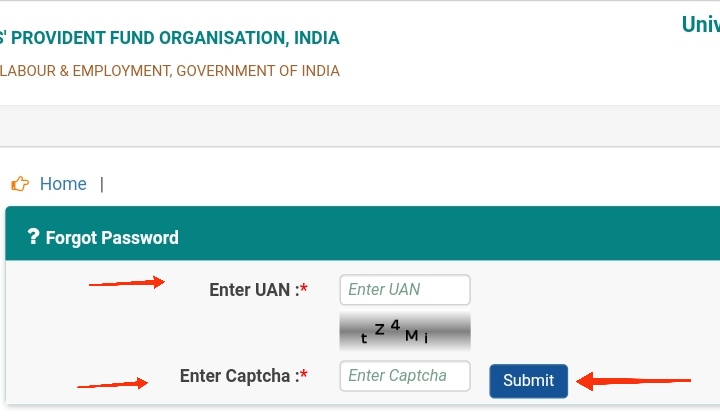

If you forget your password:

Click on the “Reset” link below the password field. Supply your UAN, registered mobile number, and CAPTCHA code to receive an OTP. Utilize the OTP to reset your password.

Additional Information:

- Activating UAN: If your UAN is not yet activated, click on “Activate UAN” on the login page.

- Mobile Number Registration: Ensure your mobile number is registered with your UAN for seamless access and services.

- UAN Card Download: After logging in, download your UAN card by navigating to the “View” section and selecting “UAN Card.”

Key Features of UAN Member e-SEWA Portal:

- View EPF passbook

- Track claim status

- Update KYC details

- File e-nomination

- Raise grievances

- Track pension payment status

- Apply for PF withdrawal

- Link Aadhaar with UAN

Remember:

- Keep your UAN and password confidential.

- Never share personal details like Aadhaar, PAN, or bank account information with anyone claiming to be from EPFO.

- Use only the official EPFO website and mobile app for transactions.

EPFO Passbook Login

Here is a step-by-step guide on how to log in to your EPFO Passbook and access your EPF information:

- Navigate to the EPFO Homepage:Open your web browser and visit the official EPFO website at https://www.epfindia.gov.in/.

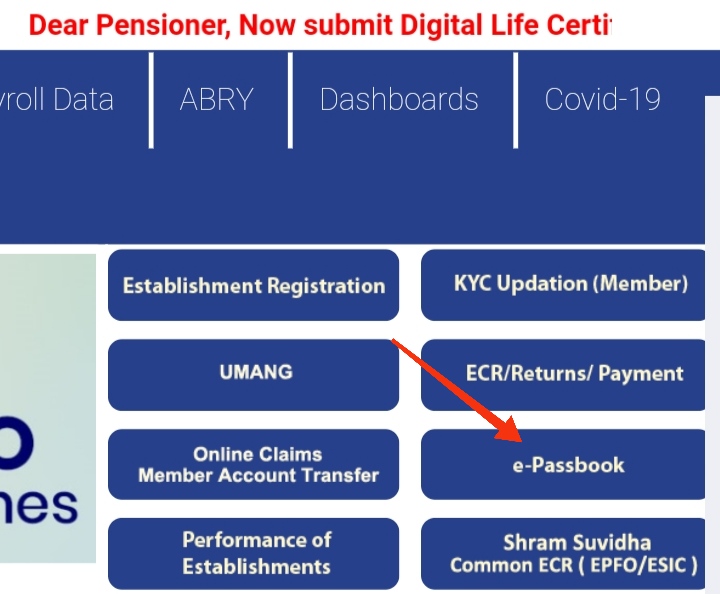

- Access “e-Passbook”:On the right side of the homepage, locate the “Our Services” section. Within this section, find and click on the “e-Passbook” option.

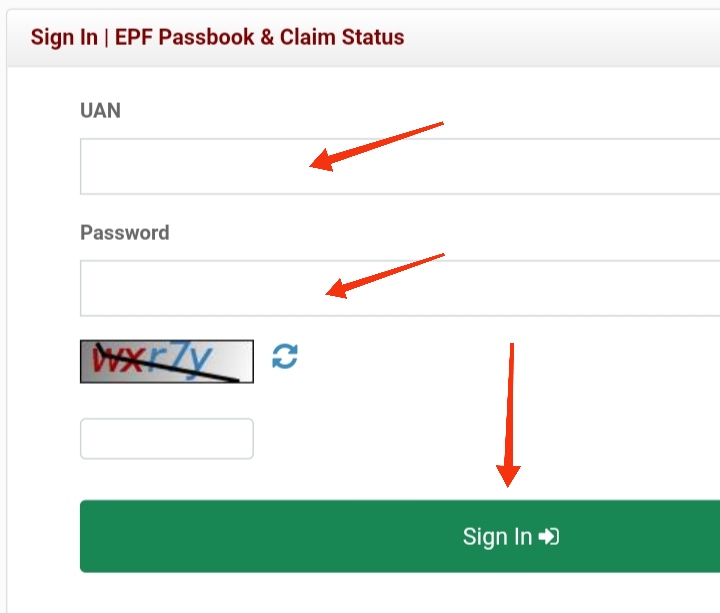

- Provide UAN, Password, and Captcha:You will be redirected to the Member Passbook login page. Enter the following details:

- Your Universal Account Number (UAN)

- Your password (the one used for the Unified Member Portal)

- The displayed CAPTCHA code.

- Click “Sign In”:After entering the required information, click the “Sign In” button to access your EPFO Passbook.

- View Passbook and Check Balance:Upon successful login, you can view your EPFO Passbook containing:

- Your EPF balance

- Details of your contributions

- Transaction history

- Interest earned

- Optional: Process Online Claims:If needed, file an EPF claim directly through the Member Passbook portal.

Key Reminders:

- UAN Number: Your UAN is crucial for accessing your EPF account. Retrieve it from your employer or the EPFO website if unknown.

- Password: Use the same password from the Unified Member Portal. Reset it through the “Forgot Password?” option if forgotten.

- Captcha: Enter the CAPTCHA code accurately for security.

By following these steps and keeping these considerations in mind, you can effortlessly access your EPFO Passbook and manage your EPF account.

EPFO Login For Employer

The Employees’ Provident Fund Organisation (EPFO) plays a pivotal role in safeguarding social security for Indian employees. As an employer, it is incumbent upon you to efficiently manage and contribute your employees’ Provident Fund (PF) deductions to the EPFO. Fortunately, the advent of online facilities has significantly simplified this process.

Accessing the EPFO Employer Portal:

- Visit the EPFO website:

- Navigate to the official EPFO website: https://www.epfindia.gov.in/

- Click on “For Employers”:

- Under the “Our Services” tab, locate and click on “For Employers.”

- Choose your login method:

- The portal offers two login options:

a. Digital Signature Certificate (DSC): Recommended for enhanced security, this method requires a valid DSC issued by a licensed Certifying Authority. b. Username and Password: If you haven’t obtained a DSC or prefer a simpler method, log in using your username and password.

Username and Password Login:

- Enter your Login Credentials:

- Username: Typically your establishment’s registration number assigned by the EPFO.

- Password: The password created during your initial registration on the portal.

- Click on “Sign In”:

- Once correct credentials are entered, click the “Sign In” button to access your employer dashboard.

Digital Signature Certificate (DSC) Login:

- Insert your DSC:

- Connect your DSC securely to your computer.

- Select your DSC:

- On the login page, choose the appropriate DSC from the available options.

- Enter the DSC PIN:

- Type the PIN associated with your DSC to authenticate your identity.

- Click on “Sign In”:

- After successful authentication, you’ll be redirected to your employer dashboard.

Employer Dashboard Features:

The EPFO employer dashboard offers a comprehensive suite of features to manage your PF obligations efficiently:

- Registration and Establishment Details: View and update your establishment’s registration information, including contact details and authorized signatories.

- Employee Management: Add, edit, and delete employee records, upload bulk employee data, and manage salary details.

- Challan Generation and Payment: Generate Electronic Challan Returns (ECRs) for monthly PF contributions, challan payments, and view payment history.

- Returns and Reports: Submit monthly, quarterly, and annual PF returns electronically, download PF contribution reports, and track claim statuses.

- Grievance Redressal: Raise and track grievances related to PF contributions or account issues.

- Help and Support: Access FAQs, user manuals, and contact information for EPFO customer support.

Benefits of Online EPFO Login:

- Convenience and Efficiency: Manage PF contributions and returns electronically, eliminating manual paperwork and saving time.

- Accuracy and Transparency: Reduce errors and ensure accurate PF accounting through automated calculations and online recordkeeping.

- Real-time Tracking: Monitor employee PF contributions, payment statuses, and claim progress in real-time.

- Improved Communication: Stay updated on EPFO notifications and policies through the online portal.

- Enhanced Security: Secure login methods like DSC ensure data protection and prevent unauthorized access.

Remember:

- Keep your username, password, and DSC PIN confidential.

- Regularly update your establishment and employee information on the portal.

- Download and store PF contribution reports and challan receipts for future reference.

- Seek assistance from EPFO customer support if you encounter any difficulties while using the online portal.

By leveraging the EPFO employer login portal, you can streamline your PF management process, ensure compliance with regulations, and contribute to the financial security of your employees.

EPFO Login Claim

The Employees’ Provident Fund (EPF) serves as a dependable safety net for Indian workers, accumulating savings over their careers to ensure financial security in later years. While the prospect of accessing and claiming these accumulated funds may seem challenging, the online EPFO claim portal greatly simplifies the process. Whether you are nearing retirement, facing unemployment, or addressing specific personal needs, understanding how to log in and navigate the EPFO claim system is essential.

Accessing the Portal:

- Visit the EPFO website:

- Navigate to the official EPFO website: https://www.epfindia.gov.in/

- Access the Member e-Sewa Portal:

- Under the “Our Services” tab, select “For Employees,” and then choose “Member UAN/Online Services.”

- Log in with your credentials:

- Enter your Universal Account Number (UAN) and password. Note that this password differs from the one used for your employer portal if applicable.

Choosing Your Claim Type:

Once logged in, you’ll encounter a dashboard displaying your EPF details and claiming options. These options fall into several categories based on your circumstances:

- Full and Final Settlement: Available upon complete retirement or permanent emigration.

- Pension: Applicable after meeting the eligibility criteria for monthly pension benefits.

- Partial Withdrawal: Permitted under specific situations like medical treatment, house purchase, or educational needs.

- Advance: Can be claimed for specific reasons such as marriage, home construction, or illness.

Completing the Claim Process:

Each claim type has specific requirements and necessary documents. The portal guides you through the process, listing relevant forms and allowing direct upload of scanned copies. Ensure you have these documents readily available:

- Proof of identity (Aadhaar, PAN card)

- Proof of address (bank statement, utility bill)

- Proof of reason for the claim (medical bills, property documents)

- Bank account details for crediting proceeds

Submitting and Tracking Your Claim:

Once you’ve filled out the form and uploaded all documents, carefully review the information before submitting the claim. You can then track its progress within the portal, monitoring its status and receiving updates via email or SMS.

Remember:

- Keep your UAN and password confidential.

- Verify the accuracy of all information before submitting your claim.

- Attach all required documents clearly.

- Allow sufficient time for claim processing.

- Contact EPFO customer support at 1800 118 005 for any assistance.

Accessing and claiming your EPF through the online portal empowers you to take control of your financial future. By navigating the platform with confidence and following these steps, you can seamlessly transition your hard-earned savings into a secure and reliable source of support throughout your golden years.

Employees Provident Fund Organization Login Unified Portal

The EPFO Unified Portal stands as your comprehensive destination for all matters related to your Employees’ Provident Fund (EPF) account in India. Whether you’re an employee, employer, or pensioner, this secure online platform empowers you to efficiently manage your account, access crucial information, and claim benefits with utmost ease.

Accessing the Portal:

- Know Your Login Credentials:

- Utilize your Universal Account Number (UAN) and password to access the portal. Obtain your UAN, a unique 12-digit identifier, from your payslip or through the EPFO website or toll-free number (1800118005).

- Head to the Portal:

- Navigate to the EPFO Unified Portal: https://unifiedportal-epfo.epfindia.gov.in/.

- Choose Your Login Type:

- Select the appropriate login option based on your role:

- Member: For employees accessing their EPF accounts.

- Employer: For employers managing their employees’ EPF contributions.

- Pensioner: For retired individuals receiving their EPF pension.

- Select the appropriate login option based on your role:

- Enter Your Credentials:

- Once you’ve selected your login type, enter your UAN and password in the designated fields.

- Click Login:

- Click “Sign in” to access your personalized dashboard.

Exploring the Portal:

The EPFO Unified Portal offers a rich array of features and functionalities based on your login type:

For Employees (Member Login):

- View Your EPF Balance.

- Download Passbook.

- Update KYC.

- File Nominations.

- Track Claim Status.

- Raise Grievances.

For Employers (Employer Login):

- Manage Employees.

- E-Return Filing (ECR)

- Challan Generation and Payment

- EPFiGMS

- Establishment e-Report Card

- Direct Fund Transfer

For Pensioners (Pensioner Login)

- View pension payment details and history.

- Download pension payment slips

- Update personal information

- Submit life certificates

- Raise grievances related to pension disbursement

Additional Features

- UMANG App Integration: Convenient access to your EPF account and government services via the UMANG app on your mobile device.

- Help & Resources: FAQs, tutorials, and other resources for effective portal navigation.

- Security & Privacy: Prioritizing data security with strong encryption and secure login protocols

Remember, Safety First:

- Never share your UAN or password with anyone, including your employer.

- Beware of phishing scams.

- Change your password regularly to enhance account security.

By leveraging the EPFO Unified Portal, take control of your EPF account, streamline the management process, and ensure your financial security for the future. Log in and explore the wealth of benefits this platform offers!

EPFO KYC: Safeguarding Your EPF Account for Efficiency

The Employees’ Provident Fund Organisation (EPFO) plays a crucial role in ensuring the financial security of Indian employees by managing provident funds, a vital retirement savings scheme. This system guarantees a steady income post-retirement, underscoring the significance of securing one’s hard-earned savings. To uphold the integrity of this process, the EPFO mandates Know Your Customer (KYC) verification for all members.

What is EPFO KYC?

KYC verification is a process aimed at establishing and confirming the identity and address of an individual. In the context of EPFO, it involves verifying:

- PAN: Your Permanent Account Number links your PF account with your income tax records.

- Aadhaar: Serving as a unique identification document, your Aadhaar card streamlines various administrative processes.

- Bank Account: Verifying your bank account ensures seamless crediting of PF contributions and withdrawals.

Why is EPFO KYC Important?

Updating your KYC information with the EPFO provides several benefits:

- Enhanced Security: KYC verification helps prevent fraudulent activities and unauthorized access to your EPF account.

- Accurate Transactions: It ensures precise crediting of PF contributions and timely processing of withdrawals and claims.

- Smoother Service Delivery: Verified KYC details enable faster resolution of grievances and efficient communication from the EPFO.

- Simplified Account Management: You can easily access your EPF passbook, track claims, and update other details online.

How to Update Your EPFO KYC?

Updating your KYC with the EPFO is a straightforward and convenient process:

- Log in to the EPFO Member e-Sewa portal: https://passbook.epfindia.gov.in/MemberPassBook/login

- Click on “Manage” and then “KYC.”

- Update your PAN, Aadhaar, and bank account details.

- Upload clear and legible scanned copies of the relevant documents.

- Submit the KYC form.

Additional Tips:

Ensure you possess valid documents before initiating the KYC update process. Upload clear and legible scanned copies of your documents. Review your details carefully before submitting the KYC form. You can track the status of your KYC update through the EPFO portal.

Remember:

Never share your UAN or password with anyone. Exercise caution regarding phishing emails or phone calls claiming to be from the EPFO. Report any suspicious activity to the EPFO immediately.

By keeping your EPFO KYC updated, you contribute to the secure and efficient management of your retirement savings. Take advantage of the online portal’s convenience and enjoy peace of mind, knowing that your EPF account is well-protected.

EPFO Login Registration Process

Greetings, esteemed employers! Are you prepared to embark on a secure journey into the realm of online EPFO management? This guide is designed to navigate you through the step-by-step process of registering on the EPFO portal, ensuring a seamless voyage towards efficient employee provident fund (EPF) administration.

Step-by-Step Registration Odyssey:

- Embark on the Portal: Set sail to the official EPFO Unified Portal at https://unifiedportal-epfo.epfindia.gov.in/.

- Choose Your Destination: Select “For Employers” from the homepage menu.

- Unfurl the Registration Flag: Click on “Online Registration of Establishment (OLRE Portal).”

- Chart Your Course: Choose “New Registration” if this is your first time registering.

- Gather Your Provisions: Prepare the following documents for your voyage:

- Establishment details: Name, address, type of industry, number of employees.

- Employer PAN card: Your valid PAN card is your passport to the EPFO realm.

- Digital Signature Certificate (DSC): Obtain a DSC from authorized agencies, serving as your electronic identity.

- Raise the Jolly Roger: Click “Register” and fill the online form meticulously, ensuring all details are accurate and complete.

- Navigate the Verification Sea: Upload your prepared documents and verify your mobile number and email address.

- Claim Your Treasure: Download the provisional registration form after successful verification.

Essential Supplies for the Journey:

Before embarking on your registration voyage, ensure you have these essentials:

- Active Internet Connection: A reliable internet connection is your trusty ship.

- Compatible Web Browser: Update your browser to the latest version for smooth sailing.

- Scanner or Digital Copies of Documents: Ensure your documents are readily accessible for uploading.

Weathering the Storms: Common Issues and Troubleshooting:

Even the smoothest seas can have choppy waters. Here’s how to handle common registration hurdles:

- Invalid PAN: Double-check your PAN number for typos or errors.

- Incorrect Document Format: Ensure your documents are uploaded in the required format (PDF, JPEG, etc.).

- Technical Glitches: If you encounter technical issues, contact the EPFO helpline (1800118005) or visit your nearest regional office.

Remember, patience and perseverance are your anchors in this journey. By following these steps and staying prepared, you’ll conquer the EPFO registration process and unlock a world of convenient and efficient EPF management for your employees and yourself.

Bonus Tip: Download the UMANG app for on-the-go access to your EPFO employer services and stay connected to your EPF journey.

So, raise your sails, employers, and embark on the exciting voyage of EPFO online registration!

EPFO Login for Employees

Welcome, fellow employees! The gateway to your financial future lies within the EPFO portal, offering access to your valuable Employee Provident Fund (EPF) account. This comprehensive guide is designed to provide you with the knowledge and confidence to effortlessly navigate the EPFO Login process, unlocking a world of convenient and empowering features.

Stepping into Your EPF Account:

- Chart Your Course: Navigate to the official EPFO Member Portal at https://unifiedportal-mem.epfindia.gov.in/.

- Raise the Anchor: Click on “Member Login” in the homepage menu.

- Prepare Your Compass: Equip yourself with two essential tools:

- Universal Account Number (UAN): Your unique 12-digit identifier, often found on your payslip.

- Password: Your personal key to access your EPF account.

- Set Sail: Enter your UAN and password in the designated fields.

- Cast Your Anchor: Click “Sign in” to enter your personalized EPF dashboard.

Why You Need an EPFO Login:

Accessing your EPFO account online provides you with valuable benefits:

- Track Your Treasure: Monitor your current EPF balance in real-time, keeping a close eye on your retirement savings.

- Download Your Passbook: Explore detailed statements of your contributions, withdrawals, and interest earned.

- Manage Your Account: Update your KYC information, nominate beneficiaries, and track claim statuses, all from the comfort of your home.

- Stay Informed: Access important notifications and updates regarding your EPF account.

- Claim Your Benefits: Seamlessly submit claims for withdrawals, house building advances, and other benefits through the portal.

Navigating Your Account Details:

Once logged in, your EPFO dashboard offers a wealth of information:

- Member Information: View basic details like name, date of birth, and employer.

- Account Summary: Get a quick snapshot of your current EPF balance, contributions, and interest earned.

- Statement of Account: Dive deeper into the details with a chronological record of all transactions.

- Nomination Details: Check your nominated beneficiaries for your EPF corpus in case of unfortunate circumstances.

- Claim Status: Track the progress of any claims you’ve filed.

Remember, Security is Key:

- Never share your UAN or password with anyone, including your employer.

- Beware of phishing scams. Avoid clicking suspicious links or providing personal information through unsolicited emails or calls.

- Change your password regularly to enhance account security.

By taking control of your EPFO account through the online portal, you empower yourself financially and pave the way for a secure future. So, set sail today and unlock the treasure trove of your EPF account!

Features and Services

The EPFO Login portal transcends its identity as a mere login page, transforming into a treasure trove replete with features and services that empower both employees and employers to efficiently and conveniently manage their Provident Fund accounts. Let’s delve into the abundant offerings it presents:

A Wealth of Features:

For Employees:

- Real-time Balance Check: Monitor the growth of your EPF corpus with a simple click, overseeing your financial future.

- Detailed Passbook Download: Access a comprehensive statement of your contributions, withdrawals, and interest earned, fostering transparency and control over your account.

- KYC Management: Update your personal information, ensuring smooth service delivery.

- Nomination Filing: Secure your loved ones’ future by naming beneficiaries for your EPF corpus.

- Claim Tracking: Monitor the progress of your claims for withdrawals, house building advances, and more, eliminating the need for manual follow-ups.

- Grievance Redressal: Report any concerns regarding your EPF account directly through the portal, ensuring prompt resolution.

For Employers:

- Employee Management: Add, edit, and manage employee details, including UANs and contributions, simplifying administrative tasks.

- E-Return Filing (ECR): Submit monthly online returns with ease, integrating online payments for contributions and charges.

- Challan Generation and Payment: Generate and pay Challans (payment slips) for contributions through various banking options, streamlining the contribution process.

- EPFiGMS: File and track grievances directly through the portal, ensuring efficient resolution.

- Establishment e-Report Card: Monitor your compliance status and track key performance indicators, enabling better management.

- Direct Fund Transfer: Transfer contributions directly into individual employee accounts for faster and more secure transactions.

Online Services at Your Fingertips:

- UAN Activation: Activate your UAN and unlock the full spectrum of online services.

- UAN-based Services: Verify employee UANs, streamline claim processing, and simplify account management.

- Online Claim Filing: Submit claims for withdrawals, advances, and death benefits electronically, saving time and effort.

- Help & Resources: Access FAQs, tutorials, and other resources to navigate the portal effectively.

Reaping the Benefits:

Using the EPFO Login offers a multitude of advantages:

- Increased Convenience: Manage your EPF account anytime, anywhere, from the comfort of your home or office.

- Enhanced Transparency: Gain real-time insights into your account and track your financial progress.

- Improved Accuracy: Reduce errors and delays by using online services.

- Faster Claim Processing: Submit and track claims electronically for quicker resolution.

- Empowered Decision-Making: Make informed financial decisions based on accurate and up-to-date information.

- Reduced Paperwork: Embrace a paperless experience for a more sustainable and efficient approach.

The EPFO Login portal is not just a convenience; it’s a powerful tool that empowers both employees and employers to take control of their Provident Fund accounts, paving the way for a secure financial future. So, unlock its potential today and experience the ease and efficiency it offers!

Security Measures

The security of your Provident Fund information within the EPFO Login portal is of utmost importance. Fortunately, the EPFO employs stringent measures to safeguard your data and prevent unauthorized access. Let’s delve into the security measures in place and explore ways to further enhance the security of your EPFO account.

Fortressing Your EPF Data:

- Secure Login Protocols: EPFO Login utilizes HTTPS encryption, ensuring the scrambling of your data during transmission to protect it from potential eavesdropping.

- Multi-Factor Authentication (MFA): Opt for an additional layer of security by enabling OTP (One Time Password) sent to your registered mobile number for every login attempt.

- Data Encryption: Sensitive information such as UAN, password, and financial details is stored in encrypted form, minimizing the risk of breaches.

- Regular System Updates: The EPFO consistently updates its systems and software to address vulnerabilities and stay ahead of evolving cyber threats.

- Access Control Measures: Strict access controls are implemented to limit who can access and modify your EPF data, preventing unauthorized internal access.

Boosting Your Account Security:

Beyond the built-in measures, consider these tips to further fortify your EPFO account security:

- Create Strong Passwords: Utilize a combination of uppercase and lowercase letters, numbers, and special characters. Avoid using personal information such as birthdays or names.

- Never Share Login Credentials: Keep your UAN and password confidential. Refrain from sharing them with anyone, including colleagues or employers.

- Beware of Phishing Scams: Exercise caution regarding emails or calls claiming to be from EPFO requesting your login details. Never click on suspicious links or attachments.

- Log Out Securely: Always log out of your EPFO account after use, particularly on public computers.

- Enable Mobile Number Verification: Link your mobile number to your EPFO account for instant OTP alerts for login attempts and other activities.

- Regular Password Updates: Change your password regularly, ideally every three months, to enhance your account’s security posture.

Building a Strong Password Wall:

Consider the following guidelines for creating and maintaining robust passwords:

- Minimum Length: Use passwords with a minimum of 12 characters.

- Character Variety: Combine uppercase and lowercase letters, numbers, and special characters.

- Uniqueness: Avoid using the same password for multiple accounts.

- Non-Personal: Steer clear of passwords containing personal information such as names, birthdays, or anniversaries.

- Passphrase Power: Consider using a passphrase – a longer sentence that is easier to remember but harder to crack.

By adhering to these tips and leveraging the existing security measures, you can establish a formidable shield for your EPFO account, ensuring the safety and security of your Provident Fund data. Remember, security is a shared responsibility, so remain vigilant and proactive in protecting your EPF treasure.

Mobile App Integration

The EPFO Login experience has broken free from desktop constraints! Enter the UMANG app, your comprehensive solution for accessing your EPF account and various government services on the fly. Let’s delve into the mobile app revolution and discover how it elevates your EPF experience.

EPFO in Your Pocket:

The UMANG (Unified Mobile Application for New-age Governance) app seamlessly integrates with your EPFO Login, providing easy access to your Provident Fund account from your smartphone or tablet. No longer are you tied to your computer!

Features at Your Fingertips:

The UMANG app for EPFO Login boasts a myriad of features, simplifying your life:

- View EPF Balance: Monitor your current EPF corpus in real-time, staying informed and tracking your financial progress.

- Download Passbook: Access a detailed statement of your contributions, withdrawals, and interest earned directly on your mobile screen.

- Update KYC: Keep your information up-to-date, ensuring smooth service delivery.

- Track Claim Status: Monitor the progress of your claims for withdrawals, house building advances, and more, all without needing a computer.

- Raise Grievances: Encounter an issue with your EPF account? Report it directly through the app for prompt resolution.

- Access e-Nominations: Secure your loved ones’ future by naming beneficiaries for your EPF corpus conveniently from your phone.

- View Account Details: Stay informed about your UAN, date of birth, and other personal information.

- Link Aadhaar Card: Simplify KYC updates and enjoy seamless access to various online services.

Downloading and Using the App:

Getting started is a breeze:

- Download the UMANG app: Available on the Google Play Store and Apple App Store.

- Register or Login: Utilize your existing EPFO Login credentials or create a new account.

- Select EPFO Services: Choose “Employees’ Provident Fund Organisation” from the list of available services.

- Start Exploring: Enjoy the convenient features and manage your EPF account from anywhere, anytime!

Remember:

- Keep your UMANG app updated for the latest features and security enhancements.

- Use a robust password and enable Multi-Factor Authentication (MFA) for added security.

- Exercise caution against phishing attempts and never share your login credentials through the app.

The integration of the EPFO mobile app is a game-changer for Provident Fund management. Embrace the convenience and empower yourself to efficiently manage your EPF account right from your pocket!

Common Issues and Troubleshooting

While the EPFO Login portal aims for seamless access, navigating it isn’t always a smooth sailing experience. Let’s delve into some common issues users encounter and provide troubleshooting tips to help you get back on track.

Challenges at Sea: Common EPFO Login Issues:

- Invalid Login Credentials: The most frequent culprit! Double-check your UAN and password for typos and ensure caps lock is off.

- Inactive UAN: Your UAN might be inactive if you haven’t joined your new employer yet or haven’t activated it after registration.

- Technical Glitches: Server overloads or temporary outages can hinder access. Try again later or contact technical support.

- Mobile Number/Email Verification Issues: Ensure your registered mobile number and email address are active and can receive verification codes.

- KYC Discrepancies: Inaccurate or outdated KYC information can cause login difficulties. Update your details through the portal or offline at your employer’s office or the EPFO regional office.

Navigating the Storm: Troubleshooting Tips:

- Reset Your Password: Click “Forgot Password” on the login page and follow the instructions to set a new one.

- Check UAN Activation: Contact your employer or visit the EPFO website to activate your UAN.

- Clear Browser Cache and Cookies: Sometimes, cached data can interfere with login. Clear your browsing history and try again.

- Try a Different Browser/Device: The issue might be browser-specific. Try accessing the portal from another browser or device.

- Update Your Contact Information: Ensure your registered mobile number and email address are current.

Navigating to Shore: Contacting Technical Support:

If the above tips don’t work, don’t hesitate to reach out for assistance:

- EPFO Helpline: Dial the toll-free number 14470 for assistance from a dedicated EPFO representative.

- EPFO Regional Office: Visit the nearest EPFO regional office for personalized support.

- EPFO Grievance Redressal Portal: File a grievance online through the EPFO website for specific issues and track its resolution.

- UMANG App Helpdesk: Within the UMANG app, access the “Help & Support” section for FAQs, troubleshooting guides, and contact information.

Remember:

- Be patient and persistent when encountering login issues.

- Keep your contact information and KYC details updated for smooth service delivery.

- Report any technical issues or discrepancies promptly to the EPFO for swift resolution.

By staying informed, proactive, and utilizing the available support resources, you can navigate the occasional bumps on the EPFO Login journey and confidently manage your Provident Fund account. So, chart your course, stay calm, and don’t hesitate to seek help if needed. Happy sailing!

Contact Information

- Toll-free number: Dial 14470 or 1800118005

- Website: https://unifiedportal-mem.epfindia.gov.in/

- Availability: 24/7

- If your are an employee: employeefeedback@epfindia.gov.in.

- If your are an employer: employerfeedback@epfindia.gov.in.

FAQ

To access your EPFO account, you’ll require two crucial pieces of information:

- Universal Account Number (UAN): This unique 12-digit identifier is assigned to you by the EPFO. You can locate it on your payslip or by reaching out to your employer.

- Password: This serves as your personal access key to your EPFO account, set up during the registration process or when resetting your password.

Essential Tips:

- Before entering them, meticulously double-check your UAN and password for typos or errors.

- Confirm you’re using the correct case for your password (e.g., ensuring caps lock is off).

- In case you forget your password, utilize the “Forgot Password” option on the login page to follow the instructions for setting a new one.

- Maintain the confidentiality of your UAN and password; refrain from sharing them with anyone, including your employer.

If you encounter difficulties during the login process, consider these helpful resources:

- EPFO Helpline: Reach out to 1800118005 for assistance from a dedicated EPFO representative.

- EPFO Website: Visit https://unifiedportal-mem.epfindia.gov.in/ for comprehensive FAQs and troubleshooting guides.

- UMANG App: Download the UMANG app for convenient access to your EPFO account and other government services.

You have various options to retrieve your UAN number:

- Through your employer:

- Payslip: Check your payslip, where your UAN is often printed. Look for a section labeled “UAN” or “Employee Provident Fund” (EPF).

- Employer’s HR department: Contact your HR department directly. They should have access to your UAN in their records.

- Online:

- EPFO portal: Visit the EPFO member portal at https://unifiedportal-mem.epfindia.gov.in/memberinterface/ and click on “Know Your UAN.” Search for your UAN using your registered mobile number, Aadhaar number, or PAN card details.

- UMANG app: Download the UMANG app, log in using your registered mobile number, and find your UAN displayed on the app’s dashboard.

- SMS:

- Send an SMS to 7738299899. In the message, type “UAN<space>Your Registered Mobile Number.” You’ll receive a reply with your UAN if the mobile number is linked to your EPF account.

- EPFO regional office:

- Visit your nearest EPFO regional office in person and provide them with your personal details like name, date of birth, and father’s name. They can assist you in retrieving your UAN.

- EPFO Helpline:

- Call the EPFO helpline at 1800118005 and speak to a representative. They can provide you with your UAN if you have your Aadhaar number or PAN card handy.

Remember:

- Keep your UAN confidential and avoid sharing it with anyone.

- Update your contact information (mobile number and email address) with the EPFO to ensure you receive important updates and reminders.

Certainly, you can discover your UAN number using your mobile number through various methods:

- EPFO Member Portal:

- Visit the EPFO member portal at https://unifiedportal-epfo.epfindia.gov.in/.

- Click on “Know Your UAN.”

- Enter your registered mobile number and click on “Request OTP.”

- An OTP will be sent to your registered mobile number.

- Enter the OTP and click on “Validate OTP & get UAN.”

- Your UAN number will be displayed on the screen.

- UMANG App:

- Download the UMANG app from the Google Play Store or Apple App Store.

- Register or login using your registered mobile number.

- Your UAN number will be displayed on the app’s dashboard.

- SMS:

- Send an SMS to 7738299899.

- In the message, type “UAN <space> Your Registered Mobile Number.”

- You’ll receive a reply with your UAN if the mobile number is linked to your EPF account.

- EPFO Helpline:

- Call the EPFO helpline at 1800118005 and speak to a representative.

- They can provide you with your UAN if you have your mobile number handy.

Additional Tips:

- Ensure your mobile number is linked to your EPF account for these methods to work.

- Keep your mobile number updated with your employer and the EPFO for smooth access to your EPF account.

- Protect your account from unauthorized access by refraining from sharing your UAN or OTP with anyone.

Updating your KYC information for your EPFO account can be done through two main methods:

- Online:

- Log in to the EPFO Member Portal at https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

- Select “My Profile” from the menu to view your personal information.

- Click on “Update KYC” to access the page for editing your details.

- Choose the specific KYC field you want to update, such as Aadhaar number, PAN card details, bank account information, or address.

- Enter the updated information and upload scanned copies of relevant documents (e.g., Aadhaar card for Aadhaar number update).

- Click “Submit” to send your KYC update request for verification.

- Offline:

- If you prefer an offline approach or lack internet access:

- Visit your employer’s HR department for assistance in filling out the necessary KYC update form. They can submit it to the EPFO on your behalf.

- Alternatively, go to your nearest EPFO regional office (find contact information on the EPFO website). Fill out the KYC update form and submit it along with the required documents.

- If you prefer an offline approach or lack internet access:

Things to keep in mind:

- Ensure you have all necessary documents for the KYC update, including Aadhaar card, PAN card, bank account details, and address proof.

- Provide clear and legible scanned copies of documents to avoid processing delays.

- Monitor the status of your KYC update request through the EPFO portal.

- Inform your employer about the update, especially if you’re updating bank account details, to ensure proper contributions.

Additional tips:

- Consider using the UMANG app for updating your KYC details.

- Regularly update your KYC information to prevent discrepancies or service interruptions in your EPFO account.

There are numerous valuable resources to help you understand and navigate the EPFO login and its services:

Official EPFO Website:

- Unified Member Portal: https://unifiedportal-mem.epfindia.gov.in/ – Offers comprehensive information about EPFO services, including login instructions, account management features, claim procedures, and FAQs.

- For Employees: https://www.epfindia.gov.in/ – Provides detailed information on employee benefits, contribution rates, and online services.

- Downloads: https://www.epfindia.gov.in/ – Access essential forms, booklets, and guidelines related to EPFO services.

- Help & Resources: https://www.epfindia.gov.in/site_en/Help.php – Find answers to frequently asked questions, contact information for regional offices, and grievance redressal mechanisms.

UMANG App:

- Download the UMANG app: https://play.google.com/store/apps/details?id=in.gov.umang.negd.g2c&hl=en_IN – A unified mobile app providing convenient access to your EPFO account and other government services. Log in using your UAN and manage your EPF account on the go.

Additional Resources:

- EPFO Helpline: Dial 1800118005 for assistance from a dedicated EPFO representative.

- EPFO Regional Offices: Visit the nearest EPFO regional office for personalized support and guidance. Find office addresses and contact details on the official website.

- News & Updates: Stay informed about the latest EPFO news, schemes, and policy changes through official press releases and social media channels.

Tips for Staying Informed:

- Subscribe to the EPFO newsletter for regular updates on your account and important announcements.

- Follow the EPFO on social media platforms (Twitter, Facebook) for quick updates and engagement.

- Attend EPFO awareness workshops or seminars organized by your employer or regional office to gain deeper knowledge about your Provident Fund benefits.

Remember, staying informed about EPFO login and services empowers you to manage your Provident Fund account efficiently. Don’t hesitate to explore the available resources and seek assistance if needed.

When facing technical challenges with your EPFO Login or seeking information about specific services, you have various avenues for support and assistance:

- EPFO Helpline:

- Toll-free number: 1800118005

- Availability: 24/7

- Benefits: Direct access to a dedicated EPFO representative for immediate assistance.

- Limitations: Long wait times may occur during peak hours.

- EPFO Member Portal:

- Website: https://unifiedportal-mem.epfindia.gov.in/

- Features: Online “Contact Us” form, FAQs section, and a grievance redressal platform.

- Benefits: Convenient and accessible around the clock.

- Limitations: Immediate solutions for technical issues might not always be available.

- UMANG App Helpdesk:

- Within the app: Access the “Help & Support” section.

- Features: FAQs, troubleshooting guides, and contact information for regional offices.

- Benefits: In-app assistance and resources.

- Limitations: Personalized support for complex technical issues may not be provided.

- EPFO Regional Offices:

- Website: https://www.epfindia.gov.in/site_docs/PDFs/Contact_PDF/ro_pro.pdf

- Benefits: Personalized assistance from experienced staff, access to physical forms, and information.

- Limitations: Requires a personal visit during office hours.

- Social Media:

- Twitter: @EPFOIndia

- Facebook: EPFO India

- Benefits: Stay updated on announcements and receive quick responses to public queries.

- Limitations: Not a substitute for direct support channels for resolving specific issues.

Choosing the right option depends on your specific needs:

- For urgent technical issues: Dial the EPFO Helpline.

- For general inquiries and FAQs: Utilize the EPFO member portal or UMANG app helpdesk.

- For personalized support and complex issues: Consider visiting an EPFO regional office.

- Stay updated and informed: Follow EPFO on social media.

Remember, seeking help is encouraged! Don’t hesitate to reach out for assistance and utilize the available resources to ensure smooth access to your EPFO account and services.

Reactivating an inactive UAN can be a straightforward process. Here are two methods to get your UAN activated:

Option 1: Online Activation:

- Visit the EPFO Member Portal: https://unifiedportal-mem.epfindia.gov.in/

- Click on “Activate UAN.”

- Choose the appropriate option:

- “I have EPF Account Number”: Enter your old PF account number and details.

- “I have Aadhaar Number/PAN Card”: Verify using your Aadhaar number or PAN card.

- Enter the captcha code and click “Get Authorization PIN.”

- Receive a one-time password (OTP) on your registered mobile number or email.

- Enter the OTP and click “Validate OTP & Activate UAN.”

- If successful, your UAN will be activated.

Option 2: Offline Activation:

- Contact your employer’s HR department for assistance in submitting necessary documents.

- Visit the nearest EPFO regional office.

- Bring KYC documents (Aadhaar card, PAN card) and proof of identity (passport, driving license).

- Fill out the UAN activation form and submit it with the required documents.

- The EPFO will process your request, and UAN activation will be completed within a few days.

Additional Tips:

- Ensure your linked mobile number and email address are active and can receive messages.

- Update KYC information if necessary.

- Keep your employer informed about the UAN activation process.

- Check the EPFO website or call the Helpline (1800118005) for the latest information on UAN activation procedures.

Remember:

- Activating your UAN is crucial for accessing your EPF account.

- Don’t hesitate to seek help if you encounter difficulties during the activation process.

Tracking your EPFO claim status is a straightforward process, and you can choose from several methods:

1. EPFO Member Portal:

- Visit the website: https://unifiedportal-mem.epfindia.gov.in/

- Log in with your UAN and password.

- Click on “Track Claim Status.”

- Enter your claim reference number or use filters for claim type and date range.

- The portal will display the current status of your claim, including updates or delays.

2. UMANG App:

- Download the UMANG app.

- Log in using your UAN.

- Select “EPFO Services.”

- Click on “Track Claim Status.”

- Follow the same steps as the portal to view claim details and progress.

3. SMS:

- Send an SMS to 7738299899 with the message “EPFOHO <space> Your Claim Reference Number.”

- Receive an SMS reply with the current status of your claim.

4. EPFO Helpline:

- Dial 1800118005 and speak to a customer care representative.

- Provide your UAN or claim reference number for them to track your claim status.

5. EPFO Regional Office:

- Visit your nearest EPFO regional office in person.

- Provide your UAN or claim reference number to the staff, and they can assist in tracking your claim status.

Tips for Efficient Tracking:

- Keep your claim reference number readily available for easy tracking.

- Ensure your mobile number linked to your EPF account is active to receive SMS updates.

- Regularly check your claim status for any updates or changes.

- Contact the EPFO helpline or visit your regional office if you have questions or concerns about your claim.

Remember, processing times can vary, so be patient and use the available resources to track your claim progress effectively.