EPF Balance Check Online is of paramount importance in ensuring financial security and planning for the future. This balance reflects the cumulative contributions made by both the employer and the employee over the years, including accrued interest. The Employees’ Provident Fund (EPF) is a government-managed savings scheme designed to secure the financial well-being of employees in India. Administered by the Employees’ Provident Fund Organization (EPFO), this initiative mandates both employers and employees to contribute a percentage of the employee’s salary towards a provident fund. The EPF scheme not only serves as a long-term savings platform but also ensures a stable financial future for employees after retirement.

By staying informed about the current EPF balance, individuals can assess their financial health, plan for major life events, and make informed decisions about their savings and investments. Regularly checking the EPF balance is a proactive step towards maintaining financial stability and making well-informed financial choices.

To enhance accessibility and convenience for contributors, the EPFO has introduced an efficient online EPF balance check system. This digital platform allows registered users to seamlessly access real-time information about their EPF balance from the comfort of their homes or workplaces. By logging into the EPFO portal, users can view detailed statements, track contributions, and stay updated on the interest earned. The online EPF balance check system empowers individuals to take charge of their financial planning, providing a user-friendly interface for a comprehensive overview of their EPF accounts.

Table of Contents

ToggleEPF Balance Check Online

The Employees’ Provident Fund Organisation (EPFO) is a governmental body entrusted with overseeing the retirement savings of millions of Indian workers. The Employee Provident Fund (EPF) is a compulsory deduction from your salary, with an equivalent contribution from your employer directed to your EPF account. Verifying your EPF balance online is possible through various methods:

- Unified Member Portal (UMP): Access the official EPFO website, log in to your UMP account using your Universal Account Number (UAN) and password. Upon successful login, navigate to the “Member Passbook” link to check your EPF balance.

- UMANG App: The UMANG app, available on the Google Play Store and Apple App Store, is a government application offering access to multiple government services, including EPFO. After downloading, either create an account or log in using your existing EPFO credentials. Once logged in, click on the “EPFO” tab and select “View Passbook” to view your EPF balance.

- SMS: Send an SMS with the message “EPFOHO <UAN>” to 9966044425. You will receive an SMS containing your EPF balance.

- Missed Call: Give a missed call to 09966044425 to receive an SMS with your EPF balance.

It’s essential to note that real-time updates to your EPF balance might not occur immediately. It could take a few days for your balance to reflect after your employer contributes to your EPF account.

Additional Tips for Checking EPF Balance Online:

- Ensure your UAN and password are readily available.

- Use a robust password and safeguard it securely.

- Refrain from sharing your UAN or password with anyone.

- Exercise caution against phishing scams; the EPFO will never solicit personal information via email or SMS.

How to Check EPF Balance Using UAN Number

Employees wishing to check their EPF account balance using their UAN number can follow these steps:

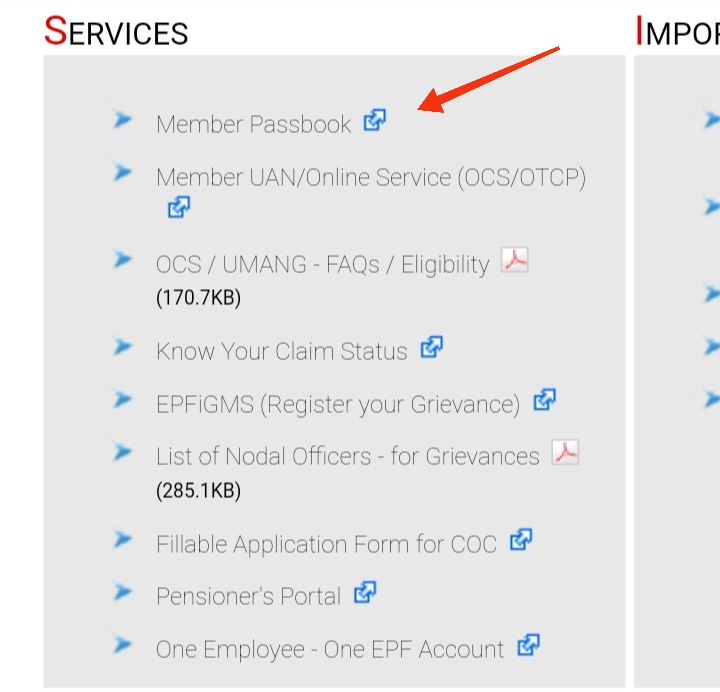

- Visit the official EPFO website.

- Click on the “Our Services” option on the homepage.

- Select “For Employees.”

- Navigate to “Member Passbook.”

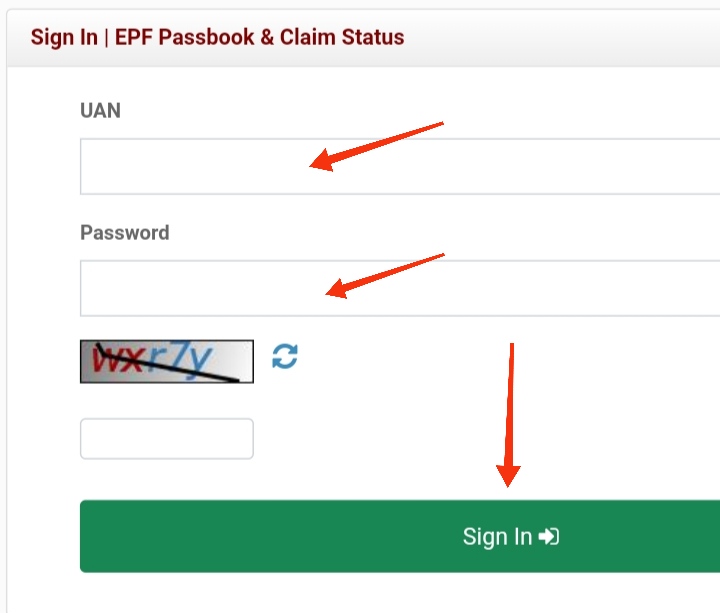

- On the new page, enter your UAN number, password, and captcha code, then click “Sign In.”

- A new page will display basic employment information; choose your current member ID.

- After selecting the member ID, find and click on “View Passbook.”

- The employee’s passbook will appear on the screen, allowing them to check their EPF passbook balance.

- The passbook will show the employee’s EPF balance, pension balance, and a detailed breakdown of contributions made by the company.

How to View EPF Balance Using the UMANG App?

Employees can use the Umang application to check their EPF balance. Follow these steps to check the EPF balance using the Umang App:

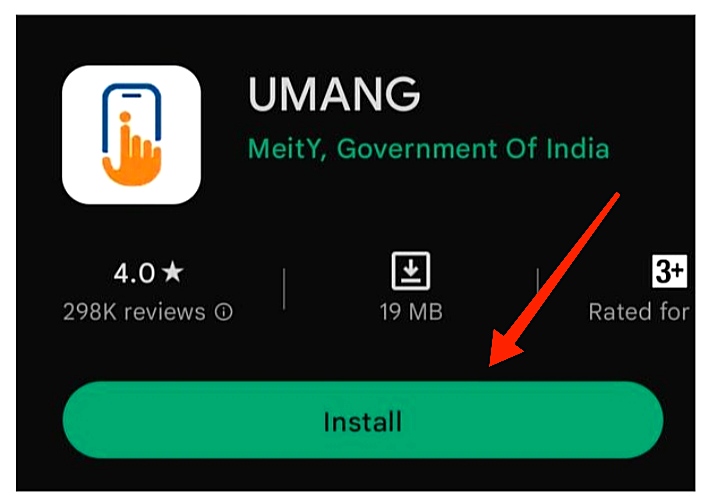

- Download the UMANG App from the Play Store.

- Open the app.

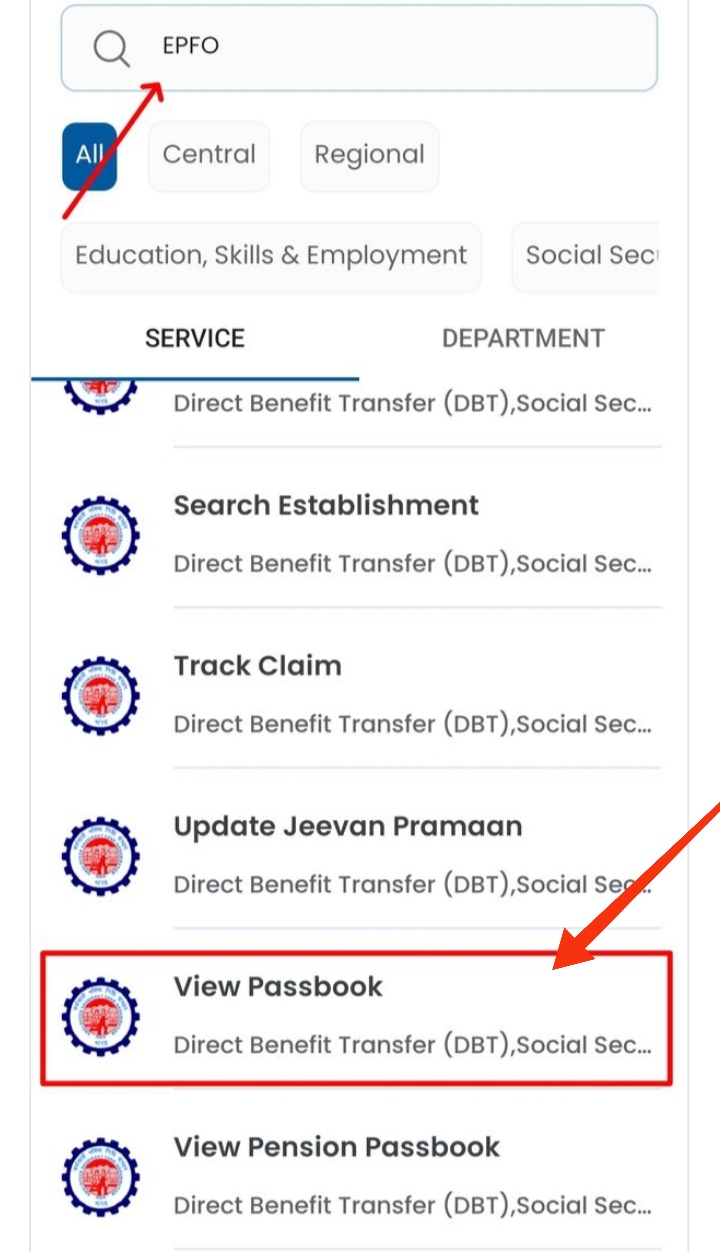

- Go to the search bar and type “EPFO” to search.

- Select the option “View Passbook.”

- Your passbook will then open on the screen, providing a detailed summary of the amount deposited in your account.

- For employees wishing to check their EPF account balance through a missed call from their registered mobile number, dial 011-22901406. Shortly after, they will receive an SMS containing complete information about their EPF account.

Alternative Methods for EPF Balance Check

While the EPFO portal offers a comprehensive way to access your EPF information, it’s not the only option. Here are three convenient alternatives, especially for those who prefer quick and easy solutions:

Using the UMANG App:

- Download and Register:

- Download the UMANG app from the Google Play Store or App Store.

- Create an account or log in using your existing EPFO credentials.

- Navigate to EPFO:

- Open the app and select “EPFO” under “All Services.”

- Access Passbook:

- Click on “Employee Centric Service,” followed by “View Passbook.”

- Enter Credentials:

- Enter your UAN and password to view your current EPF balance and transaction history.

Sending an SMS:

- Format the Message:

- Compose a new SMS with the following format: “EPFOHO <UAN>” (replace <UAN> with your actual UAN).

- Send to Dedicated Number:

- Send the message to 9966044425, the official EPFO SMS service number.

- Receive Balance:

- You will receive an SMS within minutes containing your current EPF balance.

Missed Call Service:

- Make a Missed Call:

- Simply call the dedicated EPFO missed call service number 09966044425.

- Receive Balance:

- Within minutes, you will receive an SMS with your current EPF balance.

Benefits of Alternative Methods:

- Quick and Convenient:

- These methods allow for a rapid and effortless check of your EPF balance, especially on the go.

- No Internet Required:

- SMS and missed call services work without an active internet connection, making them readily accessible even in remote areas.

- Easy to Remember:

- The dedicated phone numbers and SMS format are easy to remember and use.

Remember:

- Ensure your UAN is active and your mobile number is linked to your EPF account for these methods to work effectively.

- Update your contact information regularly to receive important updates and notifications.

- For a detailed transaction history and other functionalities, consider registering and using the EPFO portal.

These alternative methods offer a convenient and accessible way to stay informed about your EPF balance. Choose the method that best suits your needs and preferences, and keep your retirement savings journey on track!

Benefits of Checking EPF Balance Online

Staying on top of your finances is crucial, and in India, the Employees’ Provident Fund (EPF) plays a vital role in securing your retirement. Checking your EPF balance online offers not just convenience but a plethora of benefits that empower you to manage your future better:

Real-time access to EPF balance: No more waiting for annual statements or relying on intermediaries. Online platforms like the EPFO portal and UMANG app give you instant access to your current balance, empowering you to make informed decisions about your finances. You can check your balance anytime, anywhere, with just an internet connection and your UAN.

Transparency and convenience: Gone are the days of deciphering complex statements. Online platforms present your EPF information in a clear, user-friendly format, allowing you to easily track your contributions, interest accrual, and disbursements. You can filter transactions by date, year, or contribution type, gaining greater transparency and control over your retirement savings.

Tracking contributions and interest accrual: Monitoring your EPF contributions is essential to ensure your employer is fulfilling their obligations. Online platforms provide detailed breakdowns of contributions made by you and your employer, allowing you to identify any discrepancies or delays. Additionally, you can track the interest earned on your balance, giving you a clearer picture of your retirement corpus growth.

Proactive planning and informed decisions: Knowing your EPF balance empowers you to make informed financial decisions. You can assess if your current contributions are sufficient to meet your retirement goals and plan for any necessary adjustments. This knowledge can help you make informed decisions about investments, loans, or early withdrawals, keeping your future in mind.

Peace of mind and reduced stress: Uncertainty about your retirement savings can be a source of stress. Regularly checking your EPF balance online provides a sense of security and reduces financial anxieties. Knowing your progress towards your retirement goals can empower you to relax and focus on other aspects of your life.

Early detection of discrepancies and errors: Online platforms allow you to spot any irregularities or errors in your EPF account. You can identify issues like missing contributions, incorrect interest calculations, or unauthorized withdrawals and take prompt action to rectify them. This proactive approach helps you safeguard your retirement savings from mismanagement or fraud.

Improved financial literacy and awareness: Regularly engaging with your EPF account online increases your financial literacy and awareness about retirement planning. You learn about various investment options, contribution rules, and tax benefits associated with the EPF scheme. This knowledge empowers you to make informed choices and manage your finances effectively.

Increased engagement and participation: Online platforms encourage active participation in managing your EPF account. You can update your personal information, nominate beneficiaries, and even make claims directly through the online portal. This increased engagement fosters a sense of ownership and control over your retirement savings.

By checking your EPF balance online, you gain valuable insights into your financial future and empower yourself to make informed decisions. So, take advantage of this convenient and secure tool, and build a secure and fulfilling retirement for yourself.

FAQ

How can I check my EPF balance online?

Checking your EPF balance online is a convenient and efficient way to stay on top of your retirement savings. Here are three easy methods you can choose from:

- EPFO Member Portal:

- Visit the official EPFO website: EPFO Website.

- Click on “For Employees” under “Our Services”.

- Select “Member Portal.”

- Log in with your activated UAN and password.

- Click on “Member Passbook” under “Services”.

- Choose the relevant member ID and click on “View Passbook [Old: Full]”.

- Your EPF balance, along with detailed transaction history, will be displayed.

- UMANG App:

- Download the UMANG App from the Google Play Store or App Store.

- Select “EPFO” under “All Services”.

- Click on “Employee Centric Service” and then “View Passbook”.

- Enter your UAN and password to access your EPF balance.

- SMS:

- Compose a new SMS with the format: “EPFOHO <UAN>” (replace <UAN> with your actual UAN).

- Send the message to 9966044425, the official EPFO SMS service number.

- You will receive an SMS within minutes containing your current EPF balance.

Additional Tips:

- Keep your UAN and password confidential.

- Update your contact information regularly.

- Regularly monitor your EPF balance to ensure contributions are made correctly.

- For any discrepancies or assistance, contact the EPFO helpline at 0120-4883800.

By following these steps, you can easily check your EPF balance online and take control of your retirement planning. Remember, a healthy EPF balance is crucial for a secure future, so make checking it online a regular habit!

Do I need to register for anything before checking my balance online?

Yes, registering for an account and activating your Universal Account Number (UAN) is essential before checking your EPF balance online. This straightforward process can be completed on the EPFO website or through the UMANG app. Here’s a step-by-step guide:

On the EPFO website:

- Visit the official EPFO website: EPFO Website.

- Click on “For Employees” under “Our Services”.

- Select “Member Portal.”

- Click on “Activate UAN.”

- Enter your Aadhaar number or PAN number and registered mobile number.

- Click on “Get OTP.”

- Enter the received OTP and click on “Validate.”

- Set a password for your UAN account.

On the UMANG App:

- Download the UMANG app from the Google Play Store or App Store.

- Select “Register” and choose “EPFO” as your department.

- Enter your Aadhaar number or PAN number and registered mobile number.

- Click on “Get OTP.”

- Enter the received OTP and click on “Validate.”

- Set a password for your UAN account.

Once your UAN is activated, you can log in to the EPFO Member Portal or UMANG app and access your EPF balance.

Additional Tips:

- Keep your UAN and password confidential.

- Update your contact information regularly.

- Regularly monitor your EPF balance to ensure contributions are made correctly.

- For any discrepancies or assistance, contact the EPFO helpline at 0120-4883800.

By completing this simple registration process, you’ll be able to easily check your EPF balance online and stay informed about your retirement savings. Remember, a healthy EPF balance is key to a secure future, so make activating your UAN and checking your balance a regular habit!

What information can I see in my online EPF passbook?

Your online EPF passbook is a valuable resource providing detailed insights into your retirement savings. Here’s a breakdown of the information you can expect to find:

1. Personal Information:

- Your name, date of birth, PAN number, and linked Aadhaar number (if applicable).

- Member ID(s) associated with your UAN.

2. Account Details:

- Current EPF balance, inclusive of contributions from both you and your employer.

- Interest earned on your contributions.

- Total balance, including accrued interest.

3. Transaction History:

- A detailed breakdown of contributions, specifying the date, amount, and contribution type (regular, voluntary, etc.).

- Interest credited to your account.

- Any withdrawals or transfers made from your EPF account.

4. Account Status:

- Indicates whether your account is active, inactive, or closed.

- Highlights any pending claims or requests.

5. Additional Information:

- Employer details, including name, address, and establishment code.

- KYC (Know Your Customer) status.

- Nomination details, if provided.

In essence, your online EPF passbook offers a comprehensive overview of your retirement savings, enabling you to:

- Track your progress towards your retirement goals.

- Verify contributions made by your employer.

- Identify any discrepancies in your account.

- Monitor interest accrual.

- Make informed decisions about your retirement plan.

Regularly checking your online passbook is essential for ensuring the accurate and efficient management of your EPF account. It empowers you to take control of your retirement savings and plan for a secure future.

Additional Tips:

- Download your passbook as a PDF for offline reference.

- Set up email or SMS alerts for important updates.

- Contact the EPFO helpline if you have any questions or concerns.

By staying informed and engaged with your online EPF passbook, you can build a solid foundation for your financial future.

What should I do if I see an error in my EPF balance?

Encountering an error in your EPF balance can be unsettling, but there’s no need to panic. Here’s a systematic approach to address and resolve the issue:

1. Verify the Source:

- Double-check your online passbook: Ensure you’re reviewing the correct member ID and date range, as past transactions or adjustments may appear differently.

- Compare with your employer’s records: Request a copy of your contribution statement from your HR department to cross-verify with your online passbook.

2. Analyze the Error:

- Identify the nature of the error: Determine if it’s a missing contribution, incorrect interest calculation, or an unauthorized withdrawal. Understanding the specifics will aid in effective resolution.

- Check the timing: Assess whether the error is recent or persistent. Recent discrepancies may be related to data entry or processing delays, while persistent issues might warrant further investigation.

3. Take Action:

- Contact your employer: If the error appears linked to your employer’s contributions, inform your HR department and request clarification or rectification.

- Raise a grievance on the EPFO portal: Log in to your UAN account and access the “Grievance Redressal” section. File a detailed complaint, attaching screenshots or supporting documents.

- Contact the EPFO helpline: Call the EPFO helpline at 0120-4883800 and explain your situation. They can guide you through the grievance process or provide additional assistance.

4. Stay Informed:

- Track the progress of your complaint: Maintain a record of your communication with your employer and the EPFO. Note down reference numbers and follow up regularly.

- Update your online passbook: Once the error is rectified, check your passbook to confirm the updated balance.

5. Seek Additional Help:

- Consult a financial advisor: If the error is complex or involves a significant amount, consider seeking professional advice from a qualified financial advisor.

- Connect with EPFO officials: In case of difficulties or delays, reach out to the EPFO regional office or head office for further assistance.

Remember, maintaining a calm and proactive approach is crucial in resolving discrepancies in your EPF balance. By following these steps and seeking help when needed, you can ensure the accuracy and security of your retirement savings.

Is it safe to check my EPF balance online?

Ensuring the safety of checking your EPF balance online is paramount, and adhering to specific precautions can help safeguard your information:

Safe Practices:

-

- Access your EPF balance exclusively through the official EPFO website (https://www.epfindia.gov.in/) or the UMANG app (available on Google Play Store and App Store). Refrain from using unofficial websites or apps to avoid potential phishing attempts.Use Secure Platforms:

- Protect Your Login Credentials:

- Maintain the confidentiality of your UAN and password. Avoid sharing these details with anyone, including your employer or colleagues. Use strong, non-predictable passwords and update them regularly.

- Beware of Phishing Scams:

- Exercise caution with emails or SMS claiming to be from the EPFO, especially those requesting personal information. The EPFO never solicits login details through unsolicited communication.

- Use a Secure Internet Connection:

- Avoid checking your EPF balance on public Wi-Fi networks. If necessary, employ a virtual private network (VPN) for enhanced security.

- Log Out After Each Session:

- Always log out of your EPFO account post-checking your balance, particularly when using a shared computer.

Additional Tips:

- Enable Two-Factor Authentication (2FA):

- If available, activate 2FA on your EPFO account for an additional layer of security. This typically involves entering a code sent to your registered mobile number or email address during login.

- Install Antivirus and Anti-Malware Software:

- Safeguard your computer and mobile device with up-to-date antivirus and anti-malware software to protect against online threats.

- Report Suspicious Activity:

- Immediately report any suspicious activity in your EPFO account, such as unauthorized withdrawals or alterations to your personal information, to the EPFO helpline at 0120-4883800.

By adhering to these safe practices and maintaining vigilance, you can minimize risks associated with checking your EPF balance online, ensuring the security of your retirement savings. Remember, treat your EPF balance as valuable information and exercise the same care and caution as with any other sensitive financial data.