Understanding the EPFO Vision & Mission is paramount for various stakeholders, including employees, employers, and policymakers. The Employees’ Provident Fund Organization (EPFO) stands as a cornerstone in India’s social security framework, dedicated to safeguarding the financial interests of millions of workers across the country. Established in 1952, the EPFO operates under the Ministry of Labour and Employment, Government of India, overseeing the implementation of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. The primary objective of EPFO is to facilitate the creation of a retirement corpus for employees, providing financial stability during their post-employment years. Under its purview, the EPFO manages various schemes, including the Employees’ Provident Fund (EPF), Employees’ Pension Scheme (EPS), and Employees’ Deposit Linked Insurance (EDLI). The EPFO plays a pivotal role in ensuring the welfare and financial security of the Indian workforce.

The vision and mission serve as guiding principles that articulate the organization’s overarching goals and the means by which it aims to achieve them. For employees, it provides assurance that their contributions to the EPF are part of a broader vision geared towards securing their financial future. Employers gain insight into the EPFO’s commitment to maintaining a robust social security framework for the workforce, influencing their engagement with the system. Policymakers, in turn, can align their strategies with the EPFO’s mission, fostering a collaborative approach towards enhancing the well-being of the nation’s workforce. Ultimately, a clear understanding of the EPFO’s vision and mission fosters transparency, trust, and active participation in the social security initiatives that impact the lives of millions of individuals.

Table of Contents

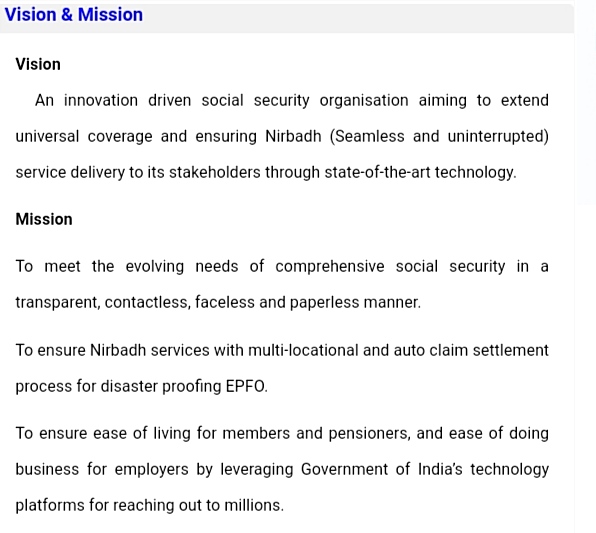

ToggleEPFO Vision & Mission

The vision of the Employees’ Provident Fund Organisation (EPFO) is to emerge as a leading force in providing comprehensive and world-class social security to the nation’s workforce. This encompasses several key aspirations:

- Universal Coverage: Expanding services to all eligible workers, bridging gaps in coverage, and ensuring access to secure retirement savings for both formal and informal sectors.

- Financial Security: Providing adequate financial resources to members after retirement through innovative investment strategies and portfolio diversification, in addition to fixed monthly pensions.

- Empowered Workforce: Enabling members to make informed financial decisions, promoting financial literacy, and fostering self-reliance among the workforce.

- Operational Excellence: Improving operational efficiency and service delivery by leveraging technology, ensuring smooth interactions for members and employers.

- Global Standards: Benchmarking practices against international social security organizations, adopting best practices, and aspiring to become a globally recognized leader in retirement security.

These aspirations, though ambitious, underscore the EPFO’s commitment to making a tangible difference in the lives of its members.

EPFO’s Mission: Serving Members with Integrity and Trust

To realize its vision, the EPFO is dedicated to a clear mission:

- Extend the Reach: Actively reaching out to eligible workers, especially those in unorganized sectors, through awareness campaigns and simplified registration processes.

- Enhance Trust: Guaranteeing the safety and security of members’ contributions, ensuring transparency and accountability in all transactions and decisions.

- Deliver Quality Services: Providing efficient and user-friendly services through digital platforms, dedicated helplines, and regional offices to simplify and expedite claim processes.

- Innovate and Adapt: Continuously seeking new ways to improve services and benefits, adapting to changing economic and social dynamics to remain relevant and effective.

- Promote Financial Inclusion: Contributing to the larger goal of financial inclusion by integrating with other government initiatives and providing financial education to members.

The EPFO relentlessly pursues this mission to build trust and confidence among its members, establish itself as a reliable partner in their financial journey, and ultimately realize its vision of a secure and empowered future for the Indian workforce. In conclusion, the EPFO’s vision and mission reflect a commitment to social well-being, financial security, and a brighter future for millions of Indian workers, leaving a lasting legacy of empowered individuals and a more secure future for all.

EPFO Vision Statement

A vision statement serves as a potent compass, directing an organization towards its envisioned future. It succinctly encapsulates core values, aspirations, and the ultimate impact an organization seeks to achieve. Understanding the EPFO’s vision statement is pivotal to comprehending its role in shaping the economic landscape and safeguarding the lives of millions of Indian workers.

Significance of the Vision Statement:

- Defines the Aspiration: The vision statement establishes a clear picture of the future the EPFO wants to create, providing direction and motivation for its stakeholders.

- Inspires Confidence: It conveys a sense of purpose and commitment to social well-being, building trust among members and fostering a positive perception of the organization.

- Aligns Efforts: The vision acts as a unifying force, guiding actions and decisions towards achieving desired outcomes, ensuring all efforts contribute to the same overarching goal.

- Measures Progress: It provides a benchmark against which the EPFO’s performance and impact can be assessed, showcasing its achievements and areas for improvement.

Presenting the EPFO’s Vision Statement:

“To be the most caring superannuation fund in the region enabling our members to have a contented retirement life.”

This concise statement encapsulates key elements of the EPFO’s vision:

- Caring Provider: It positions the EPFO not merely as a financial institution but as a caring entity, emphasizing its commitment to the well-being of its members.

- Regional Excellence: The vision aims beyond borders, aspiring to be the leading superannuation fund in the region, setting a high standard for social security initiatives.

- Contented Retirement: The ultimate goal is not just financial security but a state of contentment and well-being in retirement, where members can truly enjoy their golden years.

Analysis of Key Components:

- Focus on Members: The statement unequivocally places the EPFO’s members at the center of its vision. Their needs, aspirations, and overall well-being are the driving force behind all its efforts.

- Beyond Finances: While financial security is crucial, the vision acknowledges the emotional and social aspects of retirement, aiming to create a holistic sense of contentment and fulfillment.

- Regional Leadership: This ambitious goal emphasizes the EPFO’s desire to set a high standard for social security not just within India but across the region, inspiring other nations to adopt similar initiatives.

Conclusion:

The EPFO’s vision statement is a powerful declaration of its commitment to a secure and fulfilling future for Indian workers. By staying true to its core values of care, excellence, and member-centricity, the EPFO can continue to be a beacon of hope and security for generations to come.

EPFO Mission Statement

While a vision statement paints a grand picture of the desired future, a mission statement outlines the concrete steps an organization takes to translate that vision into reality. It defines the operational goals, strategies, and values that guide daily decisions and actions. Understanding the EPFO’s mission statement is crucial to appreciating its specific efforts in securing the financial future of its members.

Role of the Mission Statement:

- Actionable Roadmap: The mission statement translates the vision into a set of achievable objectives and strategies, providing a practical guide for day-to-day operations.

- Focus on Processes: It outlines the specific methods and approaches the EPFO employs to fulfill its vision, ensuring its resources and efforts are aligned with its core objectives.

- Measuring Progress: The mission statement serves as a yardstick for assessing the organization’s effectiveness, indicating areas of success and where further improvement is needed.

- Communicating Intent: It clearly communicates the EPFO’s priorities and intentions to its stakeholders, fostering trust and understanding of its work.

Presenting the EPFO’s Mission Statement:

“To promote and extend social security coverage through efficient and transparent administration of provident funds and related schemes for the benefit of our members.”

This concise statement outlines three key elements:

- Promoting and Extending Coverage: The mission acknowledges the need to widen the reach of social security to include both formal and informal sectors, ensuring broader financial protection.

- Efficient and Transparent Administration: It emphasizes the importance of streamlined processes, user-friendly services, and clear communication to foster trust and build member confidence.

- Benefits for Members: Ultimately, the mission focuses on delivering tangible benefits to its members, ensuring they receive their rightful dues and experience a secure retirement.

Breaking Down the Objectives and Strategies:

- Promoting Coverage: Reaching out to unorganized sectors through awareness campaigns, simplified registration processes, and flexible contribution options.

- Efficient Administration: Utilizing technology to streamline claim processing, establish convenient service channels, and enhance responsiveness to member needs.

- Transparent Operations: Regularly publishing reports, providing clear communication on policies and decisions, and ensuring accountability in all transactions.

- Enhancing Benefits: Exploring innovative investment strategies, expanding benefit schemes, and continuously reviewing and adapting the offerings to meet evolving needs.

Alignment with Stakeholders

The success of the Employees’ Provident Fund Organisation (EPFO) hinges on its ability to align its vision and mission with the diverse interests of its stakeholders, creating a delicate ecosystem. Let’s explore how EPFO’s aspirations translate into tangible benefits for its key players:

1. Employees:

- Financial Security: The core commitment to providing retirement security ensures stable monthly pensions and access to accumulated corpus, empowering individuals to lead a dignified life after their active years.

- Empowerment and Choice: Online portals and simplified processes grant employees greater control over contributions and claims, fostering ownership and financial literacy.

- Peace of Mind: Efficient management of savings relieves anxieties about the future, leading to improved morale and productivity during working years.

2. Employers:

- Talent Attraction and Retention: A robust social security benefit package helps attract and retain skilled employees, giving employers a competitive edge in the marketplace.

- Reduced Liability: While employers contribute to the provident fund, the long-term financial burden for retired employees shifts to the EPFO, alleviating pressure on budgets.

- Enhanced Compliance: Streamlined online processes and clear regulations make employer contributions and compliance easier, reducing administrative costs and ensuring legal adherence.

3. Broader Society:

- Economic Stability: A financially secure workforce translates into stable consumer spending, boosting overall economic growth.

- Reduced Social Burden: EPFO’s role in providing for retired individuals reduces the strain on government welfare programs, fostering a more robust social safety net.

- Financial Inclusion: Expanding coverage to informal sectors promotes financial literacy and brings previously excluded individuals into the formal financial system.

Analyzing the Impact:

By aligning its vision and mission with the diverse interests of its stakeholders, the EPFO creates a ripple effect of positive outcomes. For employees, it paves the way for a secure and dignified retirement. For employers, it offers a competitive advantage and reduces financial liabilities. And for the broader society, it contributes to economic stability, social well-being, and financial inclusion.

Striving for Continuous Improvement:

Maintaining this delicate balance requires constant reevaluation and adaptation. The EPFO actively seeks feedback from its stakeholders, explores innovative schemes and investment strategies, and invests in technology to improve service delivery. This commitment to ongoing improvement ensures its continued relevance and impact in the lives of millions.

Achievements and Milestones

The Employees’ Provident Fund Organisation (EPFO) has forged an impressive path in Indian social security, marked by noteworthy achievements and milestones that underscore its unwavering commitment to its vision and mission. Let’s explore some of these triumphs and analyze their impact on the organization and its stakeholders:

- Expanding Coverage:

- Universal Coverage Mission: Launched in 2010, the Universal Coverage Mission (UCM) has significantly increased EPFO’s membership, with over 260 million enrolled members as of June 2023.

- Simplified Registration: Introduction of simplified registration processes, including UAN and online registration, has facilitated the inclusion of informal sector workers, empowering previously excluded individuals to join the social security net.

- Impact: UCM’s success translates to more individuals enjoying financial security post-retirement, reducing burdens on families and society. Simplified registration fosters financial inclusion and boosts economic participation.

- Technological Transformation:

- Online Portal: The comprehensive online member portal enables members to track contributions, file claims, and access crucial information, streamlining processes and reducing physical touchpoints.

- Mobile App: The introduction of a mobile app ensures 24/7 access to accounts and services, empowering members to manage their finances conveniently.

- Impact: Technological advancements lead to faster claim processing, improved transparency, and greater member engagement. This enhances trust in the EPFO and creates a user-friendly experience for all stakeholders.

- Enhanced Benefits and Schemes:

- Increased Minimum Wage Limit: Regular revisions to the minimum wage limit for EPF contributions ensure fair contributions and higher retirement benefits for a growing workforce.

- Social Security Schemes: Beyond provident funds, the EPFO offers social security schemes like life insurance and family pension, providing additional financial protection to members and their families.

- Impact: Increased minimum wage limits and additional social security schemes expand protection and offer peace of mind to members and their families.

- Commitment to Transparency and Accountability:

- Regular Reports and Audits: Maintaining transparency through detailed annual reports and independent audits ensures responsible financial management and accountability to stakeholders.

- Grievance Redressal Mechanisms: Dedicated mechanisms like the EPFO Helpdesk and online portals allow members to voice concerns and seek timely resolutions, building trust and promoting a proactive approach to member satisfaction.

- Impact: Transparency fosters trust and confidence among members and stakeholders. Effective grievance redressal mechanisms demonstrate the EPFO’s commitment to member concerns, enhancing satisfaction and building a stronger relationship with its beneficiaries.

Challenges and Strategies

The Employees’ Provident Fund Organisation (EPFO) stands resilient amid its achievements, yet its journey towards fulfilling its vision and mission encounters notable challenges. Let’s delve into key hurdles faced by the EPFO and explore the strategic initiatives employed to surmount them:

- Expanding Coverage in Informal Sectors:

- Challenge: Difficulty in Identifying and Registering Workers due to informal sector characteristics.

- Challenge: Fluctuating Incomes and Irregular Contributions pose barriers to regular participation.

- Strategies:

- Conducting UCM Outreach Programs to raise awareness and simplify registration processes for informal sector workers.

- Introducing Micro-Pension Schemes tailored for irregular income patterns to encourage consistent contributions.

- Bridging the Digital Divide:

- Challenge: Technological Literacy Gap and limited access to digital platforms, particularly in rural areas.

- Challenge: Infrastructure Limitations, such as uneven internet connectivity, exacerbate the digital divide.

- Strategies:

- Maintaining Offline Service Channels like regional offices and helplines for those with limited digital access.

- Launching Digital Literacy Initiatives, including workshops to empower members in navigating online platforms.

- Ensuring Sustainability and Financial Stability:

- Challenge: Demographic Shifts and Aging Population require adequate funds for future pension obligations.

- Challenge: Market Volatility and Investment Management demand efficient corpus management for optimal returns.

- Strategies:

- Exploring Investment Diversification beyond traditional options to mitigate risk and ensure long-term financial sustainability.

- Gradually Raising Retirement Age in alignment with economic and social conditions to balance future liabilities.

- Enhancing Transparency and Trust:

- Challenge: Streamlining Communication and Grievance Redressal for clearer understanding of policies and processes.

- Challenge: Tackling Fraud and Misinformation to maintain the integrity of EPFO schemes.

- Strategies:

- Investing in Robust Communication Channels, such as online portals and regional offices, for timely information and query resolution.

- Promoting Financial Literacy and Awareness among members to strengthen their understanding of EPFO operations and foster trust.

Adaptability and Future Outlook

In a constantly evolving world, the ability to adapt is crucial for social security systems like the Employees’ Provident Fund Organisation (EPFO) to remain relevant and effective. Let’s explore the EPFO’s adaptability and discuss potential future trajectories based on its current goals and the changing landscape:

Adaptability in Vision and Mission:

- Evolving Workforce:

- Challenge: Rise of the gig economy and changing employment patterns.

- Adaptation: Adjusting coverage and benefit schemes to cater to diverse work models and income streams.

- Demographic Shifts:

- Challenge: Aging population and increasing life expectancy.

- Adaptation: Exploring flexible investment strategies and potentially revisiting retirement age considerations for long-term financial sustainability.

- Technological Advancements:

- Challenge: Embracing technology for improved service delivery.

- Adaptation: Leveraging technology for innovative schemes and personalized financial guidance to empower members.

Speculative Future Trajectory:

- Universal Coverage 2.0:

- Expansion: Beyond the workforce to include homemakers and the self-employed.

- Innovation: Exploring flexible contribution options and simplifying registration through technology.

- Social Security beyond Provident Funds:

- Integration: With other social security programs and offering health insurance options.

- Development: Robust post-retirement financial planning tools for a holistic safety net.

- Data-Driven Insights and Personalization:

- Utilization: Tailoring investment strategies and recommending suitable schemes.

- Focus: Providing personalized financial advice for a more member-centric and efficient system.

Challenges and Opportunities:

- Challenges: Balancing financial sustainability, adapting to technological advancements, and addressing diverse workforce needs.

- Opportunities: Innovation and growth through proactive responses to societal shifts, showcasing the EPFO as a future-proof social security system.

FAQ

What is the EPFO’s vision?

The EPFO’s vision is both ambitious and aspirational, with the goal of becoming “the most caring superannuation fund in the region, enabling our members to have a contented retirement life.” This vision statement encapsulates several key elements:

- Caring Provider:

- The EPFO aspires to go beyond being merely a financial institution, positioning itself as a caring entity that places the well-being of its members at the forefront.

- Regional Excellence:

- Aiming for regional leadership, the EPFO seeks to set a high standard for superannuation funds in the region. It envisions becoming a trailblazer in social security initiatives, inspiring other nations to adopt similar approaches.

- Contented Retirement:

- The ultimate objective extends beyond financial security. The vision envisions a retirement phase marked by contentment and overall well-being, where members can genuinely enjoy their golden years.

This visionary statement strongly resonates with the needs and aspirations of millions of Indian workers, offering the promise of a secure and fulfilling future post their active years. The EPFO actively pursues this vision through initiatives such as expanding coverage, optimizing processes, improving benefits, and fostering transparency. In doing so, the organization makes a significant and positive impact on the lives of its members and contributes to the well-being of the broader society.

What is the EPFO’s mission?

Certainly! Let’s delve deeper into the key elements of the EPFO’s mission:

- Expanding Reach and Quality:

- Reach: The EPFO is dedicated to broadening its coverage, specifically targeting eligible workers in informal sectors. This ensures that everyone, regardless of their employment type, has access to robust retirement security.

- Quality: Continuous improvement is at the core of the EPFO’s mission. The organization focuses on refining its services and processes, ensuring efficient benefit delivery, reliable systems, and user-friendly experiences for its members.

- Consistent and Ever-Improving Standards:

- Compliance: Adhering strictly to regulations and ensuring the fair application of policies is a priority for the EPFO. This commitment builds trust and confidence among members and stakeholders.

- Benefit Delivery: The EPFO recognizes the importance of consistent and timely delivery of benefits such as pensions and withdrawals, crucial for financial stability and peace of mind in retirement.

- Winning Approval and Confidence:

- Transparency: Open and clear communication, providing accessible information, and establishing channels for feedback are fundamental to building trust and understanding.

- Fairness and Honesty: Upholding principles of impartiality in decision-making, adherence to ethical standards, and responsible management of funds are foundational values.

- Contribution to Economic and Social Well-being:

- Financial Security: The EPFO’s provision of secure retirement income significantly contributes to economic stability and lessens potential burdens on social welfare programs.

- Empowerment: Granting access to savings and financial tools empowers individuals, enabling them to proactively plan for their future and actively participate in the economy.

In essence, the EPFO’s mission reflects a comprehensive commitment to enhancing public old-age income security through an approach that combines expanding reach, maintaining high standards, fostering trust, and actively contributing to the overall well-being of its members. This multi-faceted strategy positions the EPFO as a pivotal player in shaping a secure and prosperous future for the Indian workforce.

How does the EPFO’s vision and mission benefit employees?

The vision and mission of the EPFO translate into tangible and multifaceted benefits for employees, encompassing financial security, empowerment, and peace of mind throughout their professional journey and into retirement. The specific ways in which employees benefit are outlined below:

Financial Security:

- Secure Pensions: The EPFO’s primary function is to furnish monthly pensions post-retirement, ensuring a consistent income stream and financial autonomy during the retirement phase.

- Accumulated Corpus: Contributions from both employees and employers create a corpus that matures at retirement, providing a lump sum for supplemental income or various financial needs.

- Life Insurance and Family Pension: Additional schemes like life insurance and family pension offer financial protection to the families of employees in the event of untimely demise.

Empowerment:

- Choice and Control: Online portals and simplified processes empower employees to monitor their contributions, file claims, and manage their accounts with enhanced control and transparency.

- Retirement Planning Tools: Resources on the EPFO’s website guide employees in retirement planning, assisting them in making informed decisions about their savings and future financial endeavors.

- Financial Literacy: Through workshops and resources, the EPFO promotes financial literacy, equipping employees with the knowledge to manage their finances effectively and make informed choices.

Peace of Mind:

- Reduced Anxiety about the Future: The knowledge that their retirement savings are securely managed by a trustworthy organization like the EPFO alleviates anxiety about financial stability in later years.

- Focus on the Present: With a secure future in sight, employees can concentrate on their current work and career goals without undue financial worry.

- Enhanced Trust and Confidence: The EPFO’s commitment to transparency and member welfare cultivates trust and confidence among employees, resulting in increased satisfaction with the organization.

Furthermore, it’s crucial to emphasize that these benefits extend beyond formal sector employees. The EPFO actively endeavors to broaden coverage to informal sector workers through simplified registration processes and flexible contribution options, aiming to provide similar advantages to all individuals in the workforce. Additionally, the organization’s contribution to economic stability creates a conducive environment for businesses and job creation, ultimately benefiting employees across the spectrum in the long term.

What are some challenges the EPFO faces in achieving its vision and mission?

Certainly! Here’s a more detailed exploration of the challenges faced by the EPFO and potential strategies to address them:

Expanding Coverage:

- Informal Sector Workers:

- Challenge: Identifying and registering individuals in the informal sector with limited documentation.

- Strategy: Implement targeted awareness campaigns, collaborate with local communities, and introduce simplified registration processes to overcome documentation barriers.

- Digital Divide:

- Challenge: Uneven access to technology hindering online registration in rural areas.

- Strategy: Develop offline registration options, establish mobile service centers, and conduct digital literacy programs in underserved regions.

- Employer Compliance:

- Challenge: Encouraging compliance from smaller employers.

- Strategy: Provide incentives for compliance, simplify reporting processes, and conduct outreach programs to educate small employers on the benefits of participation.

Efficient Administration:

- Processing Backlog:

- Challenge: Managing a large backlog of claims.

- Strategy: Implement process optimization measures, leverage technology for faster processing, and hire additional personnel during peak periods.

- Technological Infrastructure:

- Challenge: Maintaining robust digital infrastructure.

- Strategy: Invest in regular upgrades, cybersecurity measures, and regional data centers to ensure efficient service delivery and data security.

- Human Resource Capacity:

- Challenge: Ensuring a well-trained workforce.

- Strategy: Invest in continuous training programs, recruit skilled personnel, and explore partnerships with educational institutions to build a skilled talent pool.

Financial Sustainability:

- Demographic Shifts:

- Challenge: Coping with an aging population.

- Strategy: Periodically review and adjust retirement age, explore alternative funding sources, and encourage voluntary contributions to bolster the fund.

- Investment Decisions:

- Challenge: Navigating market fluctuations.

- Strategy: Diversify investments, conduct regular risk assessments, and collaborate with financial experts to optimize returns.

- Balancing Contributions and Benefits:

- Challenge: Maintaining fiscal balance.

- Strategy: Periodic reviews of contribution and benefit structures, and adopting dynamic policies based on economic conditions.

Transparency and Trust:

- Communication Gaps:

- Challenge: Ensuring clear and timely communication.

- Strategy: Utilize multiple communication channels, including digital platforms, regional offices, and SMS alerts, to keep members informed.

- Fraud and Misinformation:

- Challenge: Addressing fraudulent activities.

- Strategy: Implement stringent fraud detection mechanisms, educate members on recognizing authentic communications, and collaborate with law enforcement agencies.

- Grievance Redressal:

- Challenge: Streamlining grievance redressal.

- Strategy: Enhance online grievance submission options, establish dedicated helplines, and expedite resolution processes for member concerns.

These strategies, combined with the EPFO’s ongoing initiatives, demonstrate a commitment to addressing challenges and ensuring the organization remains effective in fulfilling its vision and mission.